The Ultimate Guide to Car Insurance

The Ultimate Guide to Car Insurance

There are lots of deciding factors to consider when you buy a new car - one of the most important being the cost. We don't just mean the price of the car or monthly payments, but the running costs too, and namely, the insurance. It's something that you need to purchase by law, and although you'll never want to use it - accidents do happen.

No need to worry or get confused about car insurance, we have it covered!

Why do I need car insurance?

If you drive a car, you need insurance. It's as simple as that, and in fact, it's illegal to not have it. Sure, insurance is an expense, but it's an essential one that you absolutely need to pay, and having it means that you're protected if you were ever to be involved in a car accident.

What happens if I don't have car insurance?

The penalties for driving without insurance are as severe as you'd suspect and could mean a fine of up to £5000 and six penalty points on your license. If your case were to end up in court, you could even find yourself disqualified from driving all together, as well as your car being seized.

If you end up in a car accident, regardless of whose fault it is, your insurance will help you out. The level of cover that you have will determine just how much it will help. There is no one-size-fits-all package, and choosing which company and policy is right for you can be confusing.

What are car insurance groups?

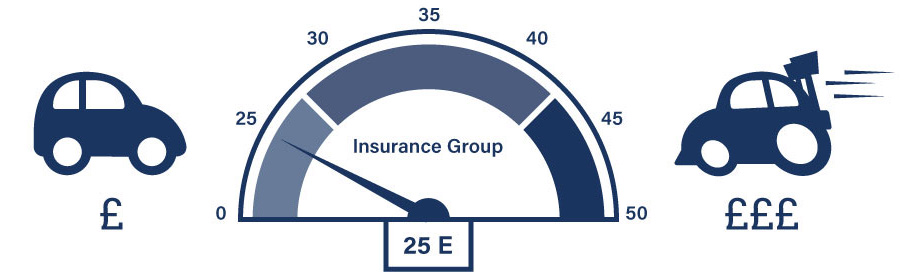

Every car in the UK is placed in an insurance group, ranging from group 1 (which are the cheapest to insure) to 50 (the most expensive) and are considered when your insurer calculates your premium.

These insurance groups change frequently, and the ranking depends on so much more than just the value of the car.

Other factors that can contribute to the groupings are:

Cost of Parts

Repair Time

Performance

Security Features

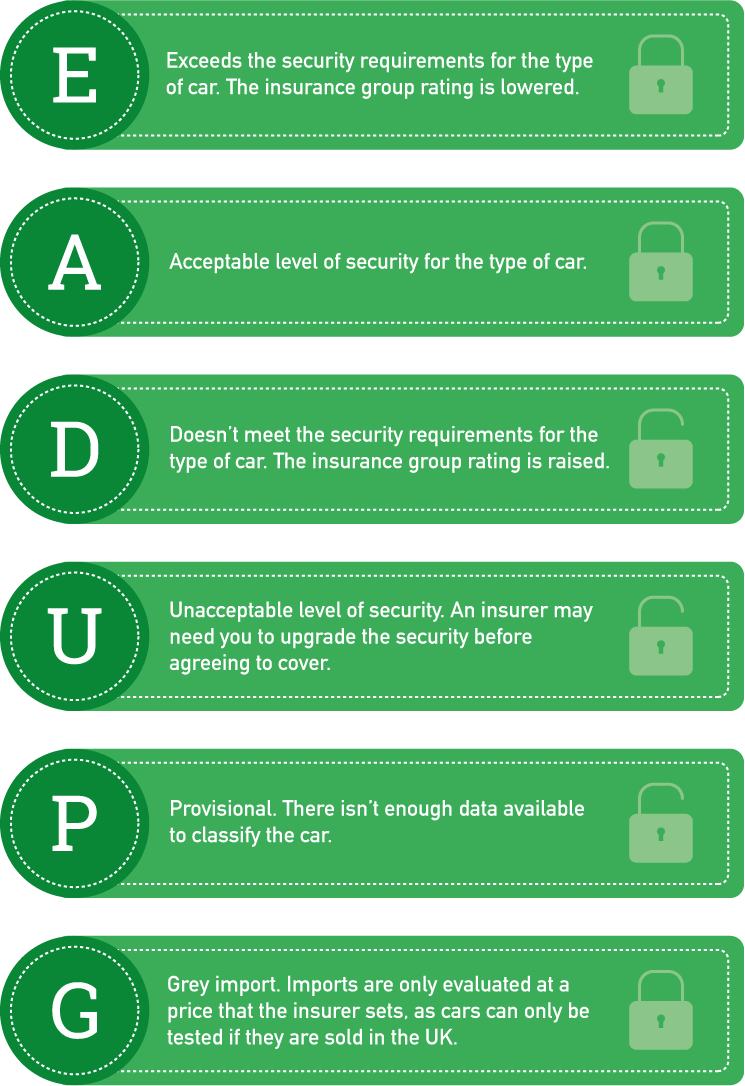

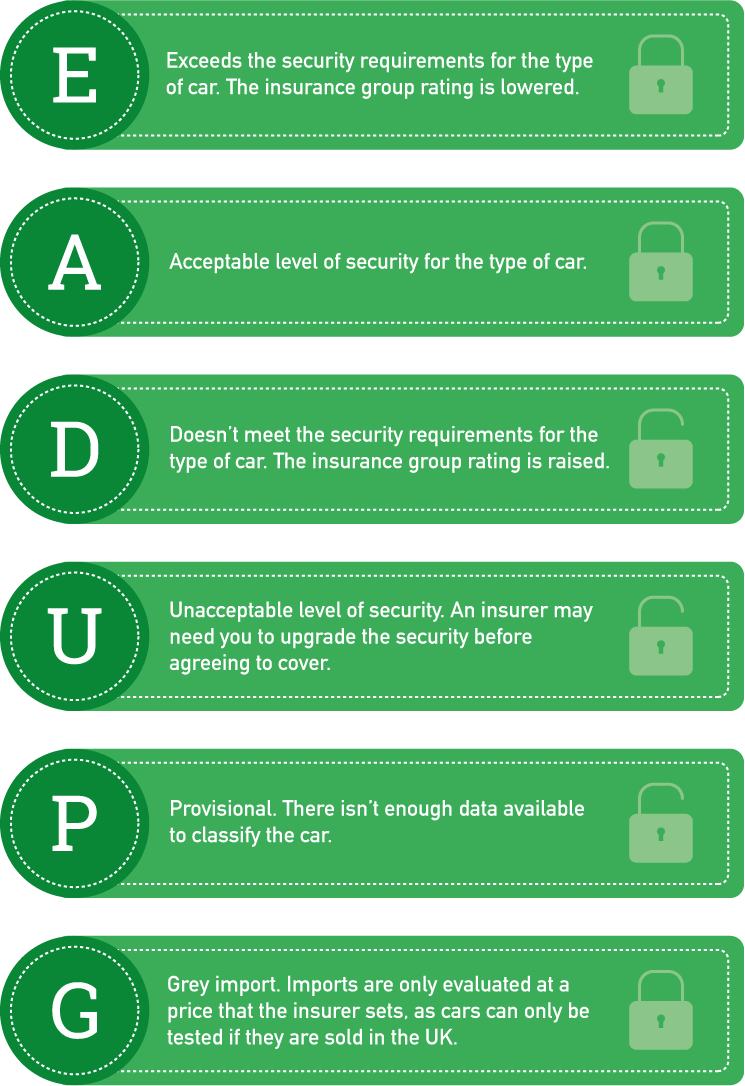

The security of your car will play a big part in how it's grouped, as theft is one of the main reasons for an insurance claim. The following suffixes after the group number represent the security level of your car:

There are plenty of tools online to help you find out which car insurance group your car fits into. Try the tool on Compare the Market.

What different types of insurance are there?

Comprehensive

Comprehensive, or 'fully-comp' as it's sometimes referred to, covers any damage to your own vehicle, even if the accident is your own fault. There are usually a few more benefits included too, such as windscreen protection and the use of a courtesy car when needed.

Sounds expensive, right? Wrong! Surprisingly, comprehensive cover is often the cheapest option. In the past, high-risk drivers would try to cut their insurance costs by choosing the lowest protection, and insurers soon realised that they were processing more claims from high-risk drivers with third party policies. Therefore, these policies were associated with a higher crash risk.

Third party

The bare minimum level of cover required by law, and the most basic level of cover, third party policies cover damage to other vehicles, injury to others, and damage to property. However, it doesn't cover any damage to your own car or injuries you sustain following an accident that is your own fault.

Third party, fire and theft

Unsurprisingly, as the name suggests, a third party, fire and theft policy includes everything covered by a third party policy, but with the additional protection for your car if it catches fire or is stolen.

What is multi-car insurance?

Multi-car insurance policies are designed for people and families who have more than one car. This could be a family home with more than one car, a couple living together with two or more cars, or even a couple who live at different addresses but have their own cars.

Rather than having individual policies for each car, a multi-car policy groups all of the policies with one insurer so they are dealt with together, with one single renewal date. Most providers will offer a discount for multi-car policies, but there is no guarantee that it'll be the cheapest option.

What is a no-claims bonus?

For every year that you drive without making a claim on your car insurance, your insurer will reward you with one year's no claim bonus (NCB). This means that when it's time to renew your policy, you'll get a discount which is accumulated each year. So, the more years you drive without claiming on your insurance, the higher your discount will be when the time comes to renew!

What is a protected no-claims bonus?

You can choose to safeguard your no-claims bonus by paying an additional amount on top of your premium. This means that even if you were to make a claim, your no-claims bonus will stay intact. Although protecting your no-claims bonus may sound like a no-brainer, you'll need to work out whether risking losing your no-claims discount outweighs the extra cost of protection. Which will cost you more over time? (According to MoneySupermarket, protecting your no-claims discount adds an average of £62 to the cost of your annual premium.)

What is an excess?

Your excess is a contribution that you'll need to pay towards a claim you make on your policy. For example, if your excess is £250 and you have an accident which results in a claim for £1000, your insurer will keep the initial £250 and give you the remaining £750.

A lot of the details will depend on your own driving history and the cost of protecting your discount. Our advice? Use a comparison site to check the difference of a quote without a no claims discount, and again with no-claims protection to make sure you're getting the best deal.

What is a named driver?

If you share your vehicle, or have family members or friends who often use it, you may consider adding them to your car insurance policy as a named driver. This can sometimes make your car insurance cheaper, although that is not always the case. If you decide to add an extra driver to your policy, make sure you have their permission, and if they have their own policy, they will need to let their insurer know too.

If you only need to add a named driver temporarily, you can opt for a short-term car insurance policy.

Carbase's tips on getting the best deal on your car insurance

Beware of auto-renewing

Car insurers make it as easy as possible for you to auto-renew your policy every year, but this isn't always the cheapest option and could actually end up costing you.

According to research carried out by MoneySuperMarket, British motorists collectively waste £652.5 million a year by auto-renewing their policies.

Shop around for the best deal

This is undoubtedly our number one tip for getting the best deal on your insurance, especially if you're renewing your policy. Use an online comparison service to do the hard work for you, and make sure it's a like-for-like comparison. What may seem to be a cheaper policy may not include everything you need or is included in alternative policies.

It's also worth checking the insurers that don't show up on the comparison sites, such as Direct Line and Aviva.

Check out a blackbox policy

Also known as a telematics policy, a blackbox policy monitors your driving using a black box which is installed in the dashboard of your car, and rewards more 'careful' drivers with a lower premium.

Increase your excess

If you're looking to reduce your premium, see how much you can save by increasing your voluntary excess. Generally speaking, the higher the excess, the lower the premium, but it's important to remember that you will need to afford this payment should you have an accident - so be realistic!

Consider paying annually rather than monthly. Sure, spreading the cost of your car insurance may feel a little more manageable, but paying monthly by direct debit means that you are more than likely paying more for your insurance than if you were to pay all in one go, or by credit card. This is because many insurers charge interest when you opt to pay monthly, so read the small print before you confirm how you'd like to pay for your cover.

Fit some safety measures

Although many cars now come with these as standard, making sure your car is fitted with an approved alarm, and immobiliser and a tracking device can reward you with around 5% discount on your car insurance.

Get a dash cam

As well as helping to encourage safe driving, dash cams can be used to get a discount on your car insurance. Dashboard cameras give a driver's eye view of the road, and a small number of insurers offer a discount of around 10-15% if you have a dash cam such as Swiftcover, RAC, Adrian Flux and Axa.

There are some things to consider though - there will be terms and conditions attached to any discounts on policies, and you may need to purchase a particular brand of dash cam and get it professionally fitted.

Choose the words you use for your job description carefully

Believe it or not, you could make massive savings on your insurance by carefully choosing the words you use to describe your profession. Most jobs have more than one description, so as long as you're telling the truth, there is nothing wrong with tweaking the wording of your job title to see if it affects your deal.

Car Insurance FAQs

Am I covered to drive other vehicles?

This is completely down to your policy, so you should check this with your insurer. Don't assume that you're covered just because you have fully comprehensive insurance.

Will adding other drivers to my policy bring the cost down?

This depends on who exactly you're adding, how many people are on the policy, and your insurer. Occasionally adding additional drivers will lower the cost, but this is in no way guaranteed.

What is a multi-car policy?

This policy allows motorists with two or more cars who live at the same address to cover their cars on the same policy. This often works out cheaper than paying for two individual policies.

Can I get cover if I have driving convictions?

Yes, you can get cover, but your choice of insurers may be limited depending on how serious your convictions are. You are also likely to pay higher premiums.

What happens if I'm involved in an accident with a driver with no insurance?

Anyone who is injured or has their property damaged by an uninsured driver is protected by The Motor Insurers' Bureau and will be given compensation.

Is car insurance cheaper for women?

No. Since 2012 the European Court of Justice's gender ruling stated that gender will not come into consideration when calculating premiums.

What is GAP insurance?

Guaranteed Asset Protection (GAP insurance) can be used to pay the difference between what you paid for your vehicle, and what the insurer will pay out in the case of a write-off. Without GAP insurance, the insurer will only pay the market value of the vehicle.

What happens if I modify my car?

It's important to tell your insurer about any modifications you make to your car, as this means you will be changing the manufacturer's specification and your cover could be invalidated.

Should I get car hire excess insurance when I rent a car?

Absolutely. It's always a good idea to take out insurance when hiring a car, although make sure you're aware of the costs before doing so. Getting covered by an independent insurer rather than the car rental company is usually the cheaper option.

Do I need insurance if my car has a SORN?

If you have a vehicle that you don't use and is kept off the road, you don't have to pay to insure it as long as you have filed a Statutory Off Road Notification (SORN). As all vehicles registered in the UK must be insured, sending a SORN to the DLVA is the only legal way to stop paying for your insurance.

Now that you know all you need to know about car insurance, head over to our finance guides to find out more about purchasing your next car!

What happens if I don't have car insurance?

The penalties for driving without insurance are as severe as you'd suspect and could mean a fine of up to £5000 and six penalty points on your license. If your case were to end up in court, you could even find yourself disqualified from driving all together, as well as your car being seized.

If you end up in a car accident, regardless of whose fault it is, your insurance will help you out. The level of cover that you have will determine just how much it will help. There is no one-size-fits-all package, and choosing which company and policy is right for you can be confusing.

What is an excess?

Your excess is a contribution that you'll need to pay towards a claim you make on your policy. For example, if your excess is £250 and you have an accident which results in a claim for £1000, your insurer will keep the initial £250 and give you the remaining £750.

A lot of the details will depend on your own driving history and the cost of protecting your discount. Our advice? Use a comparison site to check the difference of a quote without a no claims discount, and again with no-claims protection to make sure you're getting the best deal.

Check out a blackbox policy

Also known as a telematics policy, a blackbox policy monitors your driving using a black box which is installed in the dashboard of your car, and rewards more 'careful' drivers with a lower premium.

What is a multi-car policy?

This policy allows motorists with two or more cars who live at the same address to cover their cars on the same policy. This often works out cheaper than paying for two individual policies.

Carbase Reviews

Carbase is proud to be Rated Excellent by our customers, with reviews showcasing our dedication to quality vehicles and outstanding service. From helping you find the perfect family SUV to delivering a seamless buying experience, our customers trust us for all their motoring needs. Explore our Carbase reviews to see why we’re the South West’s trusted car supermarket.