RAC Combined GAP and RTI Insurance Explained

RAC Combined GAP and RTI Insurance Explained

Did you know that an average of 384,000 cars are written off in the UK every year?! Here at Carbase we have partnered up with RAC to provide you with the optional protection of Combined GAP & RTI Insurance. GAP Insurance is also available on our commercial vehicles. Find out more here >

What is GAP insurance and how will it benefit you?

Firstly you should know that GAP stands for 'Guaranteed Asset Protection'. In this instance, the asset in question is your new car, and GAP insurance is designed to protect its value at purchase, in the event that it is stolen or damaged beyond repair during the term of your finance agreement.

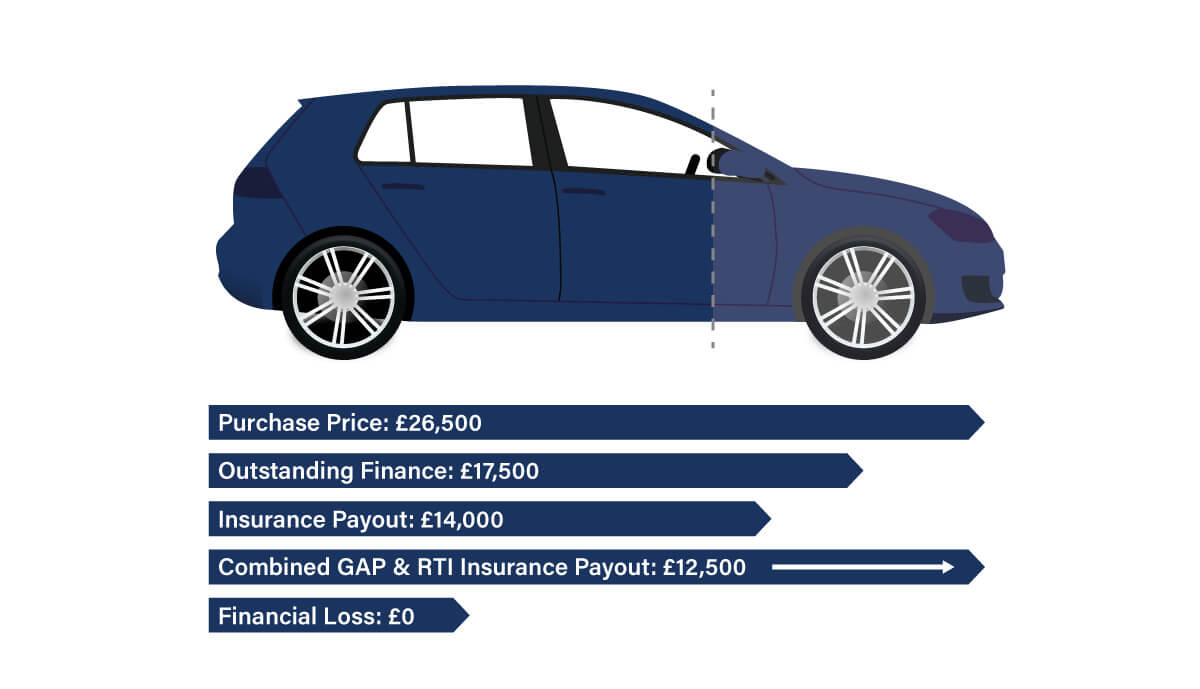

Say you have bought a used car with a great finance agreement, but unfortunately the car is stolen and cannot be recovered. Your car insurance provider will offer you a settlement sum for your stolen car, but this will be its market value at the time of the theft and may not necessarily equal what you still owe on your finance deal.

It would work in the same way if your car was involved in an accident that wrote it off. Having a GAP insurance policy ensures that you wouldn't lose the difference in value between what your insurance company offer you in settlement, and what you still owe on the car - which of course, you would still need to pay your finance provider.

So, GAP insurance can be very useful in getting you back on your feet financially if you're offered a sum that's less than you owe, especially if you need to get yourself another car too.

Car Written Off

Car Stolen

What is RTI insurance?

RTI stands for 'Return to Invoice'. Rather than paying out the difference between an insurance settlement figure and what you still owe on your finance agreement, an RTI insurance policy may boost the settlement sum up to equal the original price of the car - the price on the invoice.

So, if your car was stolen or written off, you'd have the peace of mind that comes with knowing you would receive back the same amount you originally agreed to pay for the car, including any deposits.

How does Combined GAP and RTI insurance work?

There's no obligation at all to take out GAP or RTI insurance when you start a car finance agreement; these options are simply there if you decide you would like additional financial protection. With any luck, you will never need GAP or RTI insurance.

At Carbase, we offer RAC Combined GAP and RTI insurance. This product gives you both types of protection; you will be covered for both eventualities and your premium will provide whichever is greater - either the GAP between your settlement and what you still owe on your finance agreement, or the RTI price, up to the cost of the car.

It is always worth considering GAP and RTI insurance and we'll happily talk you through the pros and cons to help you decide if taking this combined product is right for you. It's all part of our commitment to clear, customer-focused service here at Carbase - why not take a look at our selection of used cars and vans now to see if we can help you secure your next vehicle?

Find out more about the benefits of our Member's protection program