Vehicle Tax Rates - Registered April 2017 Onwards

From 1 April 2017, buyers of factory new cars will be required to pay the first year of registation based on a new CO2 emissions charge which is based on the car's efficiency credentials. This means drivers could have to pay as much as £2,000 up-front on the first time they have their new car registered.

From the second year of registration, your vehicle tax is dependant on the list price of the vehicle from new (before any discounts).

List Price LESS Than £40,000 When New

Rates for second payment:

List Price MORE Than £40,000 When New

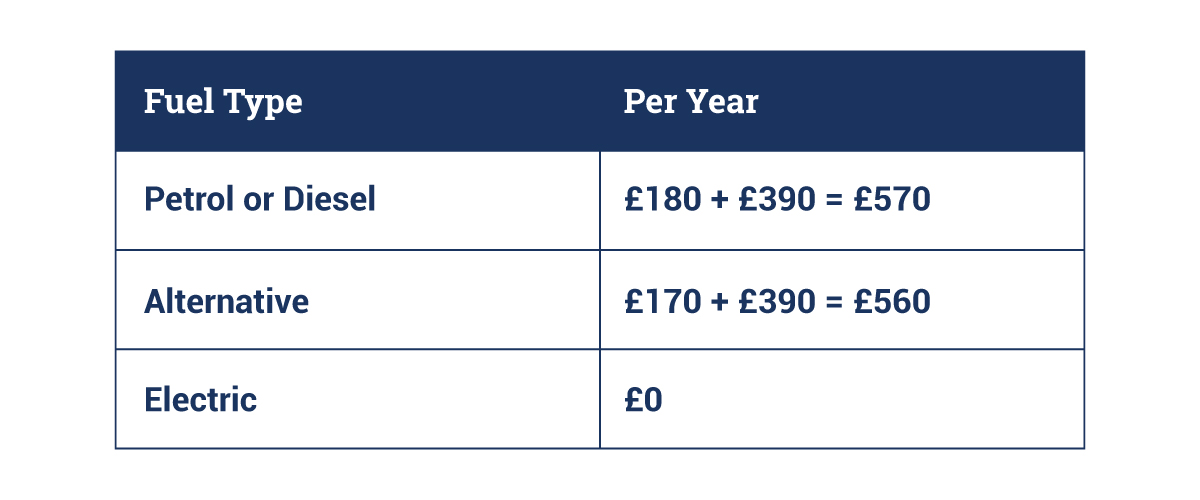

Rates for second payment:

You have to pay an extra £390 a year for vehicles that are listed over £40,000 from new and you only have to pay this rate for 5 years from the second year the vehicle is taxed. Vehicles with zero emissions, regardless of list price from new, is £0.

Figures confirmed by GOV.UK , Check Now >

These charges only apply to new cars registered after 1 April 2017, so if your car has been registered before then don't worry you will not be affected.

If you want to avoid having to pay these additional costs, we have a range of vehicles available. Vehicles registred before this date to listed vehicles below £40,000. Our Friendly, helpful team are here to help with any questions you may have.

If you are thinking of upgrading your vehicle, then take a look at our range of low tax used cars available today.